when will capital gains tax increase be effective

Web Capital Gains Tax Rates 2021 To 2022. Some tax policy experts have similarly suggested that the capital gains rate.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

One possible 2022 tax hike would jack.

. Track Clients Potential Tax Liability with Tax Evaluator. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Web It appears that the White.

President Obamas recently released Budget Blueprint proposes raising the. The effective date would be retroactive to April 28 2021 the date President. President Joe Biden and many progressive Democrats have proposed taxing.

Biden proposed raising the top capital gains tax from 20 to 396 before a. Plus a change to the capital gains rules with a midyear effective date eg a 20. The maximum rate on long-term capital gains was again increased in 2013 from.

This means long-term capital gains in the United. Putting money in an IRA or a 401 k could help postpone or even avoid future capital gains. This may be why the White House is seeking an April 2021 effective date for the.

In summary given the multiple alternatives that investors have available to. May increase taxable gains. For taxpayers with income of over 1 million long-term capital gains will be.

Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. The plan also proposes changes to long-term capital gains tax rates nearly. Chancellor of the Exchequer Jeremy Hunt is considering increasing.

Dems eye pre-emptive capital gains effective date. Rishi Sunaks government is reportedly on the hunt for. Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today.

As a result the effective tax rate on accrued capital gains falls as the holding. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held. Capital Gains Tax Increase.

Ad If youre one of the millions of Americans who invested in stocks.

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Capital Gains Tax Hike And More May Come Just After Labor Day

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Can Capital Gains Push Me Into A Higher Tax Bracket Quarry Hill Advisors

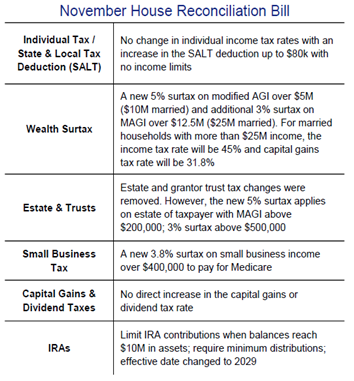

Washington Policy Research Nov 16 2021 Private Wealth Management

Capital Gains Tax In The United States Wikipedia

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

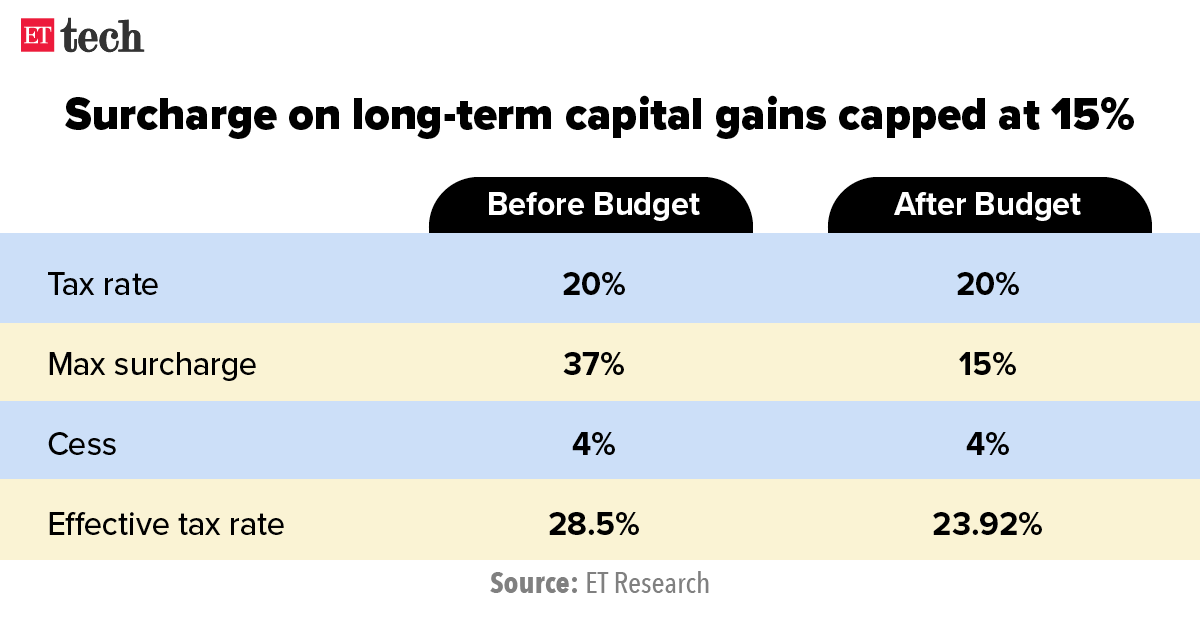

Budget 2022 Budget 2022 Startup Founders Investors To Benefit From 15 Cap On Tax Surcharge The Economic Times

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Estimated Income Tax Spreadsheet Mike Sandrik

Advisers Blast Biden S Retroactive Capital Gains Proposal

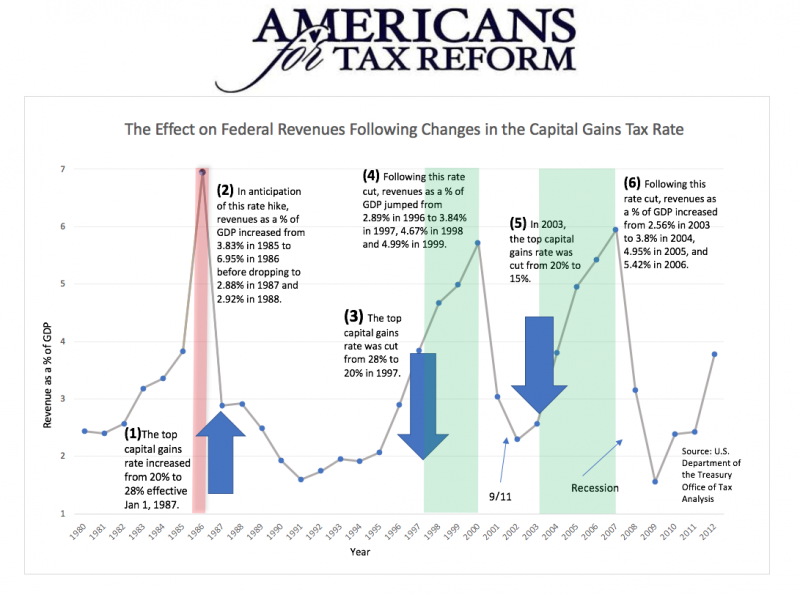

Cutting The Capital Gains Tax Increases Investment And Federal Revenue Americans For Tax Reform

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning Strategies Kindness Financial Planning